The 5-Second Trick For Business owner's policy - Wikipedia

The Complete Guide to Small Business Insurance

Business Owner Policy – BOP Definition - Investopedia Things To Know Before You Get This

Service owners insurance, also referred to as BOP insurance, is a policy that combines both home and liability coverage into one package. It's popular amongst a variety of little and medium-sized businesses such as restaurants, wholesalers, retailers and specialists. Discover more about BOP protection, cost and how you can safeguard your organization through the Progressive Benefit Service Program.

Business Insurance That Will Protect You from Disasters

This includes protection against liabilities like consumer injury and property damage, marketing injury, and item related claims. A BOP doesn't cover your workers. You'll need a separate employees' settlement policy. Residential or commercial property Provides protection for business structures and the movable residential or commercial property owned by and used for the company - referred to as business personal effects.

The Best Guide To What Is a Businessowners Policy (BOP) - Nationwide

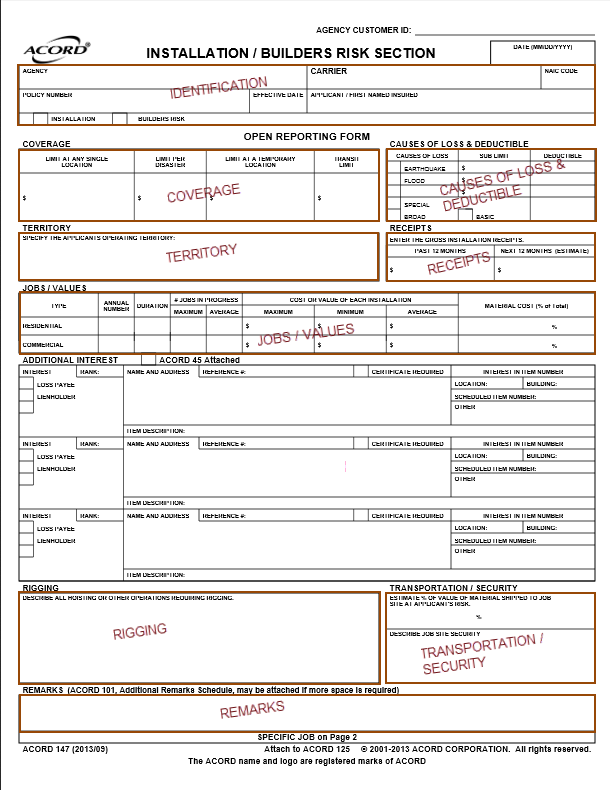

A BOP policy, like the majority of other policies, has certain coverage exemptions that you must know. If you need protection for something that isn't covered, policy endorsements may be readily available to extend protection. For example, damage from earthquakes is typically left out from a BOP. If you live in a location that's vulnerable to earthquakes, you might wish to consider adding an endorsement to your policy to extend protection.

What is Independent Contractor Insurance? - Small Business Insurance, Simplified

BOP cost In 2021, the average month-to-month expense of a BOP policy was $68 for new Progressive clients. The typical cost was $101 monthly. Keep Checking Back Here recommends that a few costly outliers made the typical expense appear greater than what many insurance policy holders invested. Your final price will depend greatly on certain attributes of your service, including coverage needs, kind of occupation, number of employees and claims history.

Getting The Business Owner's Policy - Online Quotes - Pogo Insurance To Work

Getting a customized quote is an excellent method to discover a rate that finest matches your unique scenario. Call us directly or start a quote online. Start safeguarding your organization today Our team of internal experts are professionals at assisting small company owners, like you, find BOP insurance protection. They'll help you get a quote with the very best protection for your particular organization and budget.

The liability protection offered in a BOP is the very same as a basic basic liability policy, consisting of property damage, item related claims and consumer injury. What sets a BOP apart is that it includes residential or commercial property protection for business structures and other individual residential or commercial property owned and used by the business. It can protect you from things like fire damage, hail damage, theft and vandalism.